US sales tax compliance on autopilot

Navigate ever-changing tax laws with ease. Accurate tax rates and automated filing for your peace of mind.

Navigate ever-changing tax laws with ease. Accurate tax rates and automated filing for your peace of mind.

Enhance your business efficiency and sales tax compliance with the right tools.

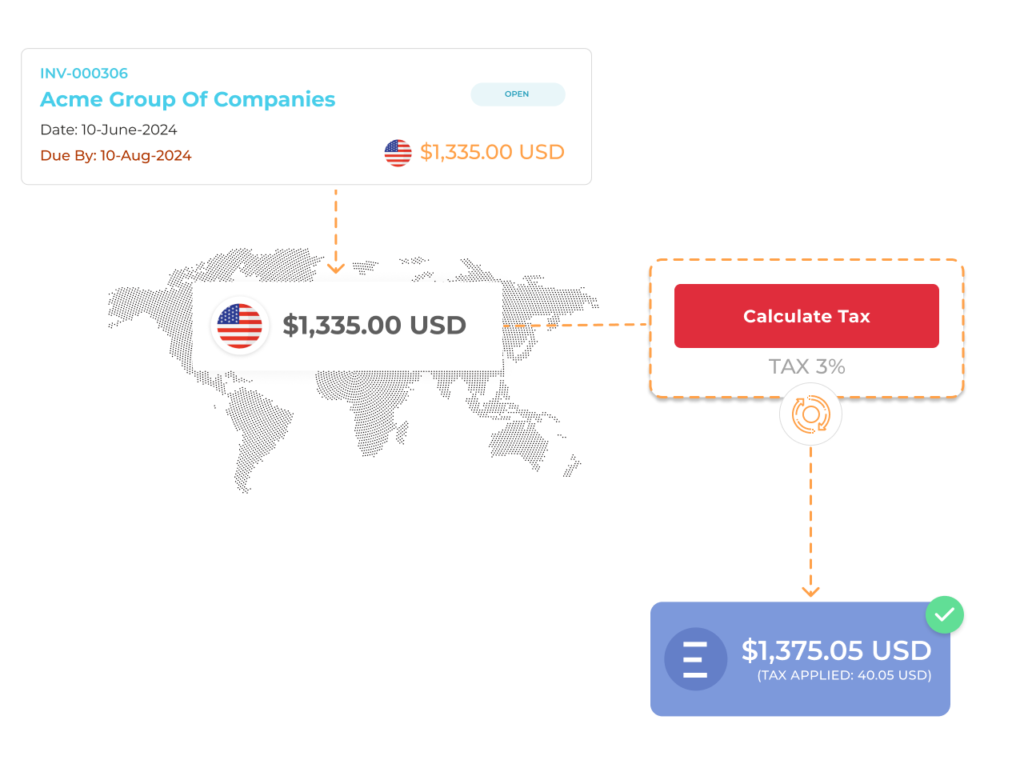

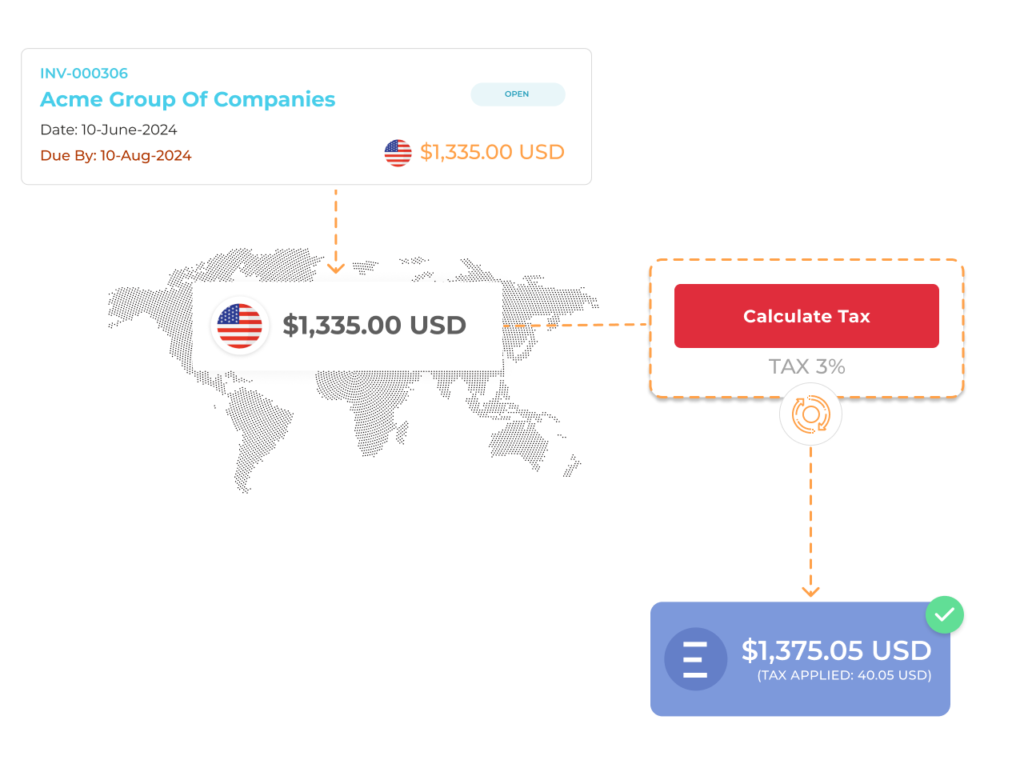

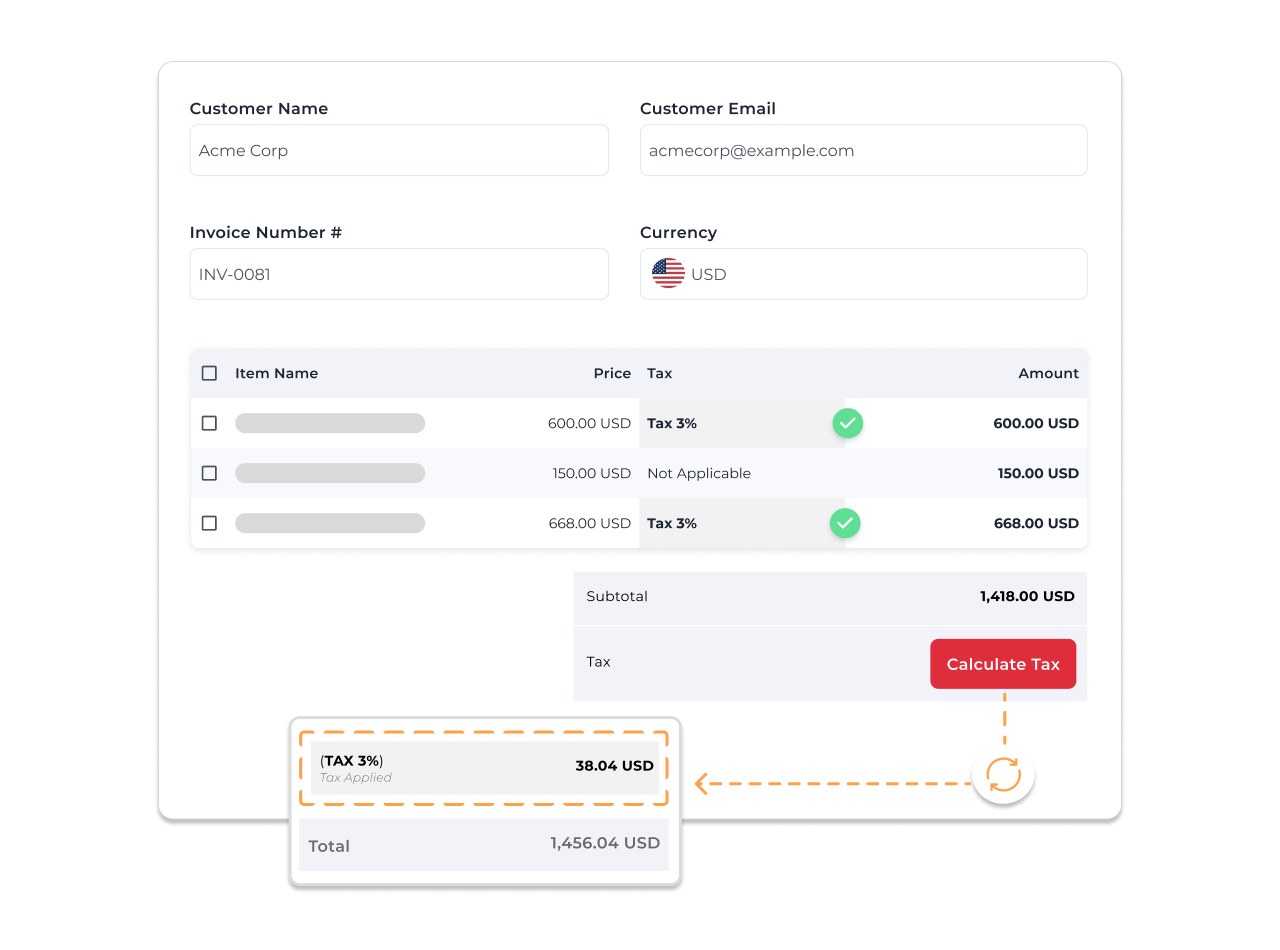

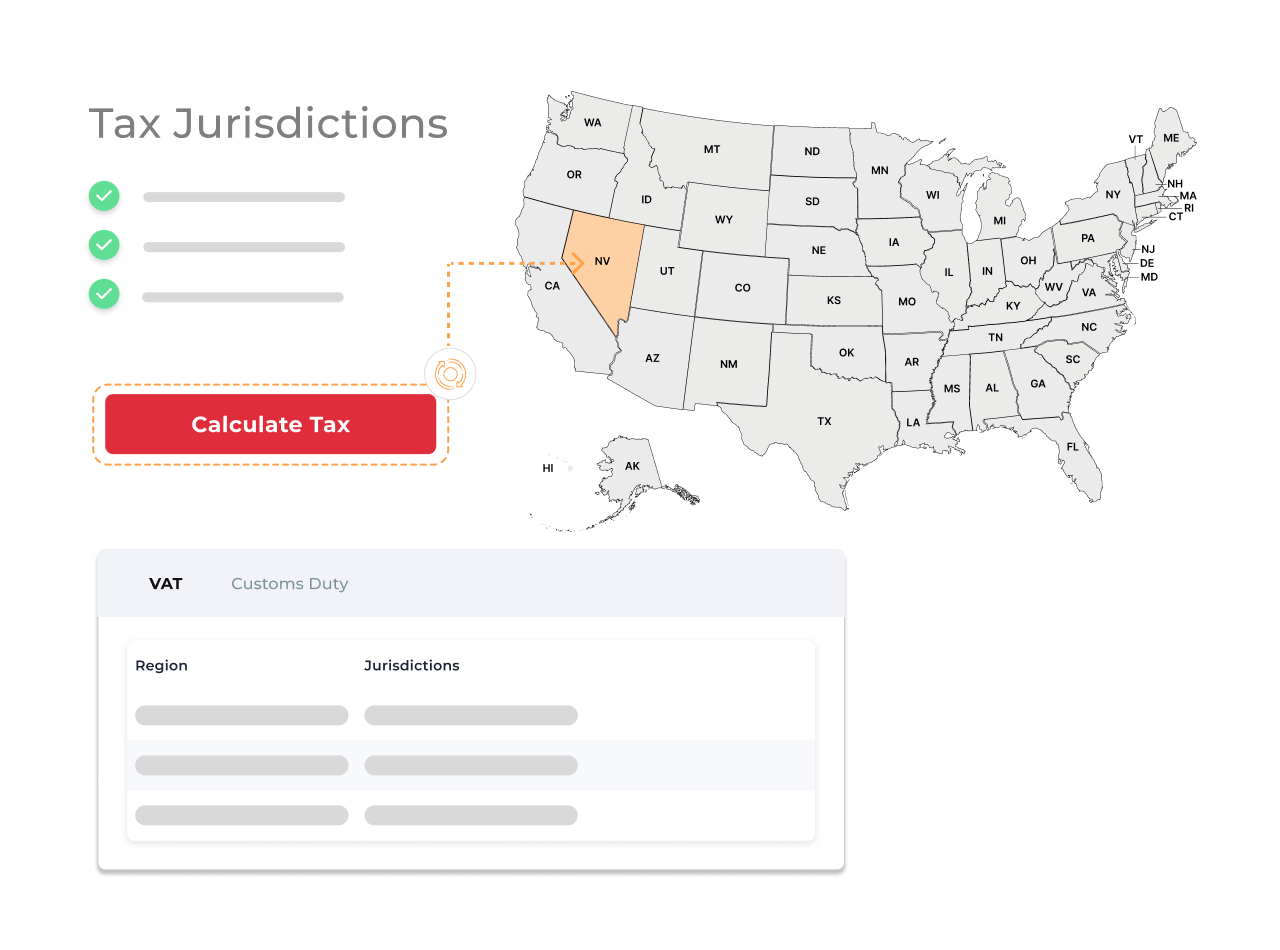

Our automated solution uses location & product data to ensure accurate tax rates are applied per item when you invoice customers, ensuring compliance across jurisdictions.

Rate calculations are applied instantly to invoices, eliminating manual data entry, reducing errors and enhancing your business experience.

Automate tax processing and stay compliant as you grow.

Our automated solution quickly adapts to changing tax rules and regulations across jurisdictions, ensuring minimal disruption and seamless compliance.

Your sales data is continuously monitored for nexus thresholds, alerting you when it’s time to register in a new state – minimizing your compliance risks.

Save time and reduce errors with automated filing and payment of your US sales tax returns. This ensures minimal penalties while optimizing cash flow.

Our team is ready with the solutions you need to advance your business.