Accounts Receivable Automation for the Modern Business

We solve inefficient AR processes.

We solve inefficient AR processes.

Cadency automates all aspects of invoicing, collections, payments, and reporting within a single cloud-based platform.

True digital transformation of your accounts receivable processes with intelligent automation that will drive efficiency, increase accuracy and accelerate cash flow while delivering great customer experiences.

Remove error-prone manual processes and maximize your AR team capacity on a single cloud-based digital platform. The unified visibility allows for strong controls, clear communication and standardization across your AR team.

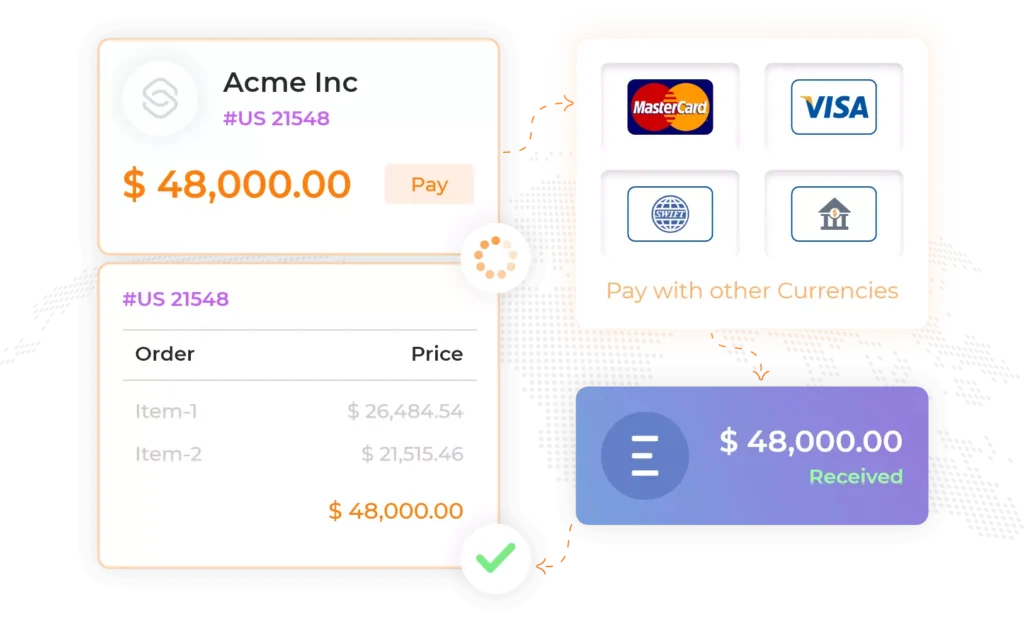

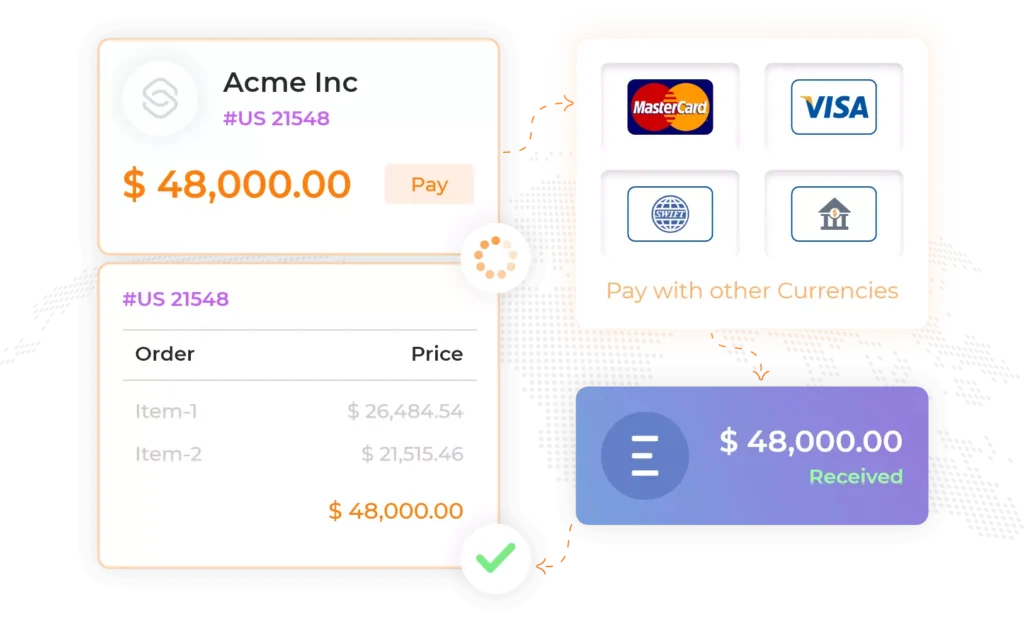

Cadency synchronizes seamlessly with your Accounting or ERP system to capture (or create) invoices and write payment data via automated cash application.

Give customers simple and friction-free payment journeys with a range of familiar local payment methods - in their country and in their currency.

Reduce manual administrative tasks by automating your invoicing processes and customer communications.

Deliver invoices automatically by creating rules-based invoicing flows based on customer attributes, product or amounts for timely and more effective invoicing processes.

Set up contextual workflows to automate one-time or recurring payment reminders. In addition, collection cadences can be configured to automatically communicate with customers having overdue accounts.

Utilize configurable dashboards to get a clear snapshot of your overall invoicing, payments, approaching deadlines, past-due invoices, open and pending client disputes, and other workflow cadences.

Cadences can be configured to run completely unattended and automatically communicate with clients or, if you prefer, can be configured to require final review by AR team members prior to execution. You can choose your level of automation based on the type of workflow, invoice, or customer attributes.

Foster collaboration among your AR team members while enhancing customer interactions.

Cadency provides a comprehensive view into your customers accounts receivable, invoices, and payments data on a single platform. This makes it easier for your staff to collaborate and provide consistently outstanding customer experiences.

Get a deep understanding of customer trends, past-due aging balances, and payment patterns to help your team quickly identify customer behaviour and prioritize strategies accordingly – clear insights all from one place.

Assign and prioritize tasks, workflows and cadences to team members. Monitor completion of tasks, customer communications, and customer activities in real-time; keeping your entire team performing and aligned.

Accounts receivable automation is the process of managing customer payments more efficiently through technology. It entails automating processes like invoicing, reminders, and reconciliation in order to boost productivity and cash flow. Real-time monitoring and quicker processing are made possible by integration with accounting systems and ERPs which also reduces administrative work and enhances financial operations.

Yes. Cadency is very flexible and can be tailored to run on its own or partially integrated to your accounting system based on your preferences.

Yes. Cadency allows you to provision payment methods per customer and also lets you define minimum or maximum allowable amounts for each payment method.

Yes. You can manage both domestic and foreign multi-currency receivables with the assistance of Cadency. International clients can opt to send payments in their preferred currency, while you can choose to invoice and receive payment in your native currency.

Our team is ready with the AR automation solutions you need to advance your business.