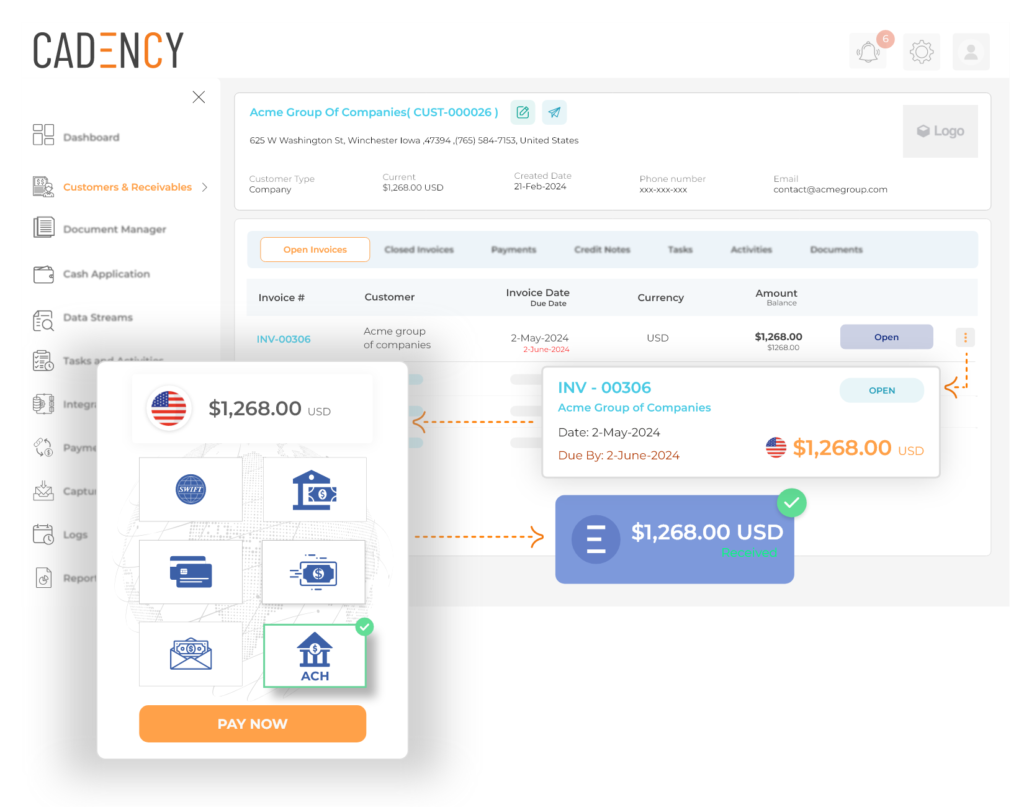

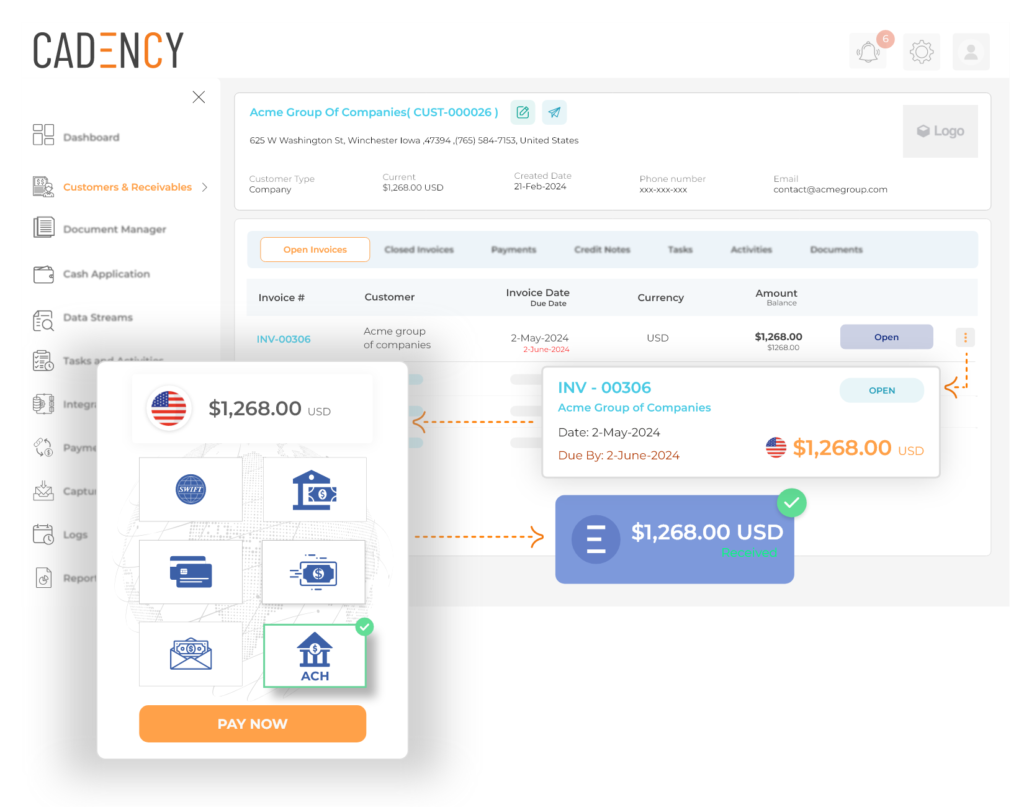

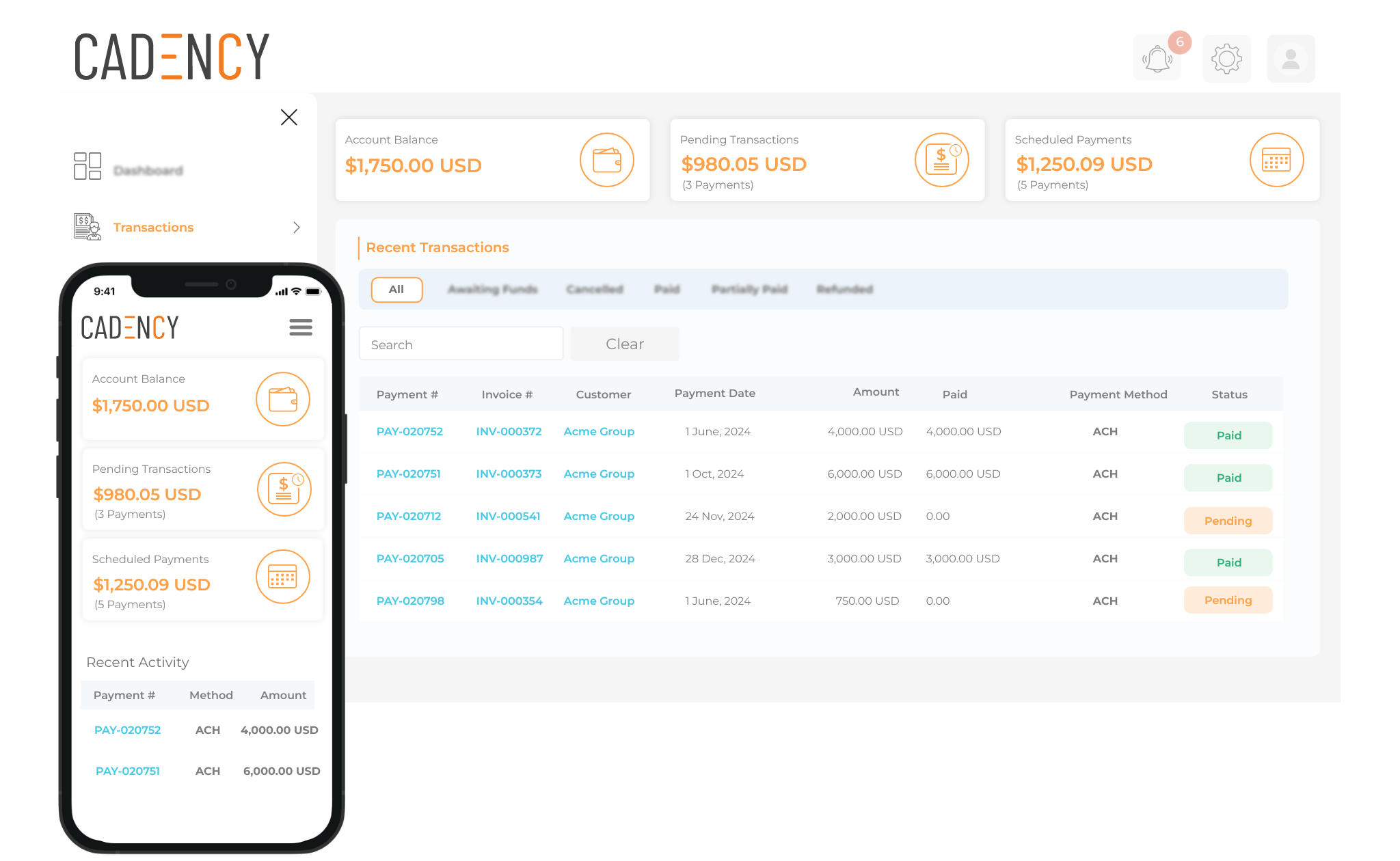

Accept ACH payments from your US customers

Embed ACH processing into your payment options and boost your receivables.

Embed ACH processing into your payment options and boost your receivables.

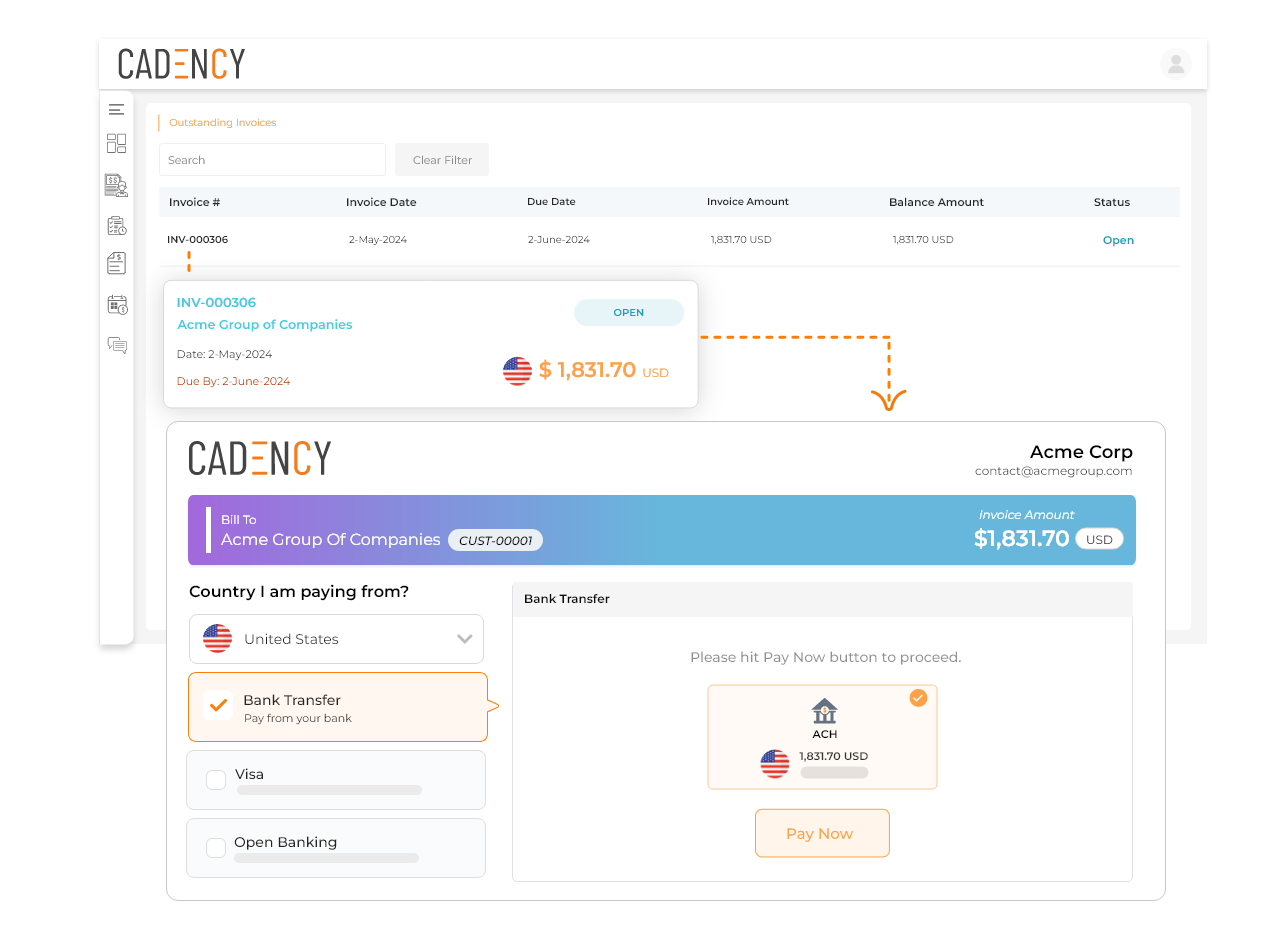

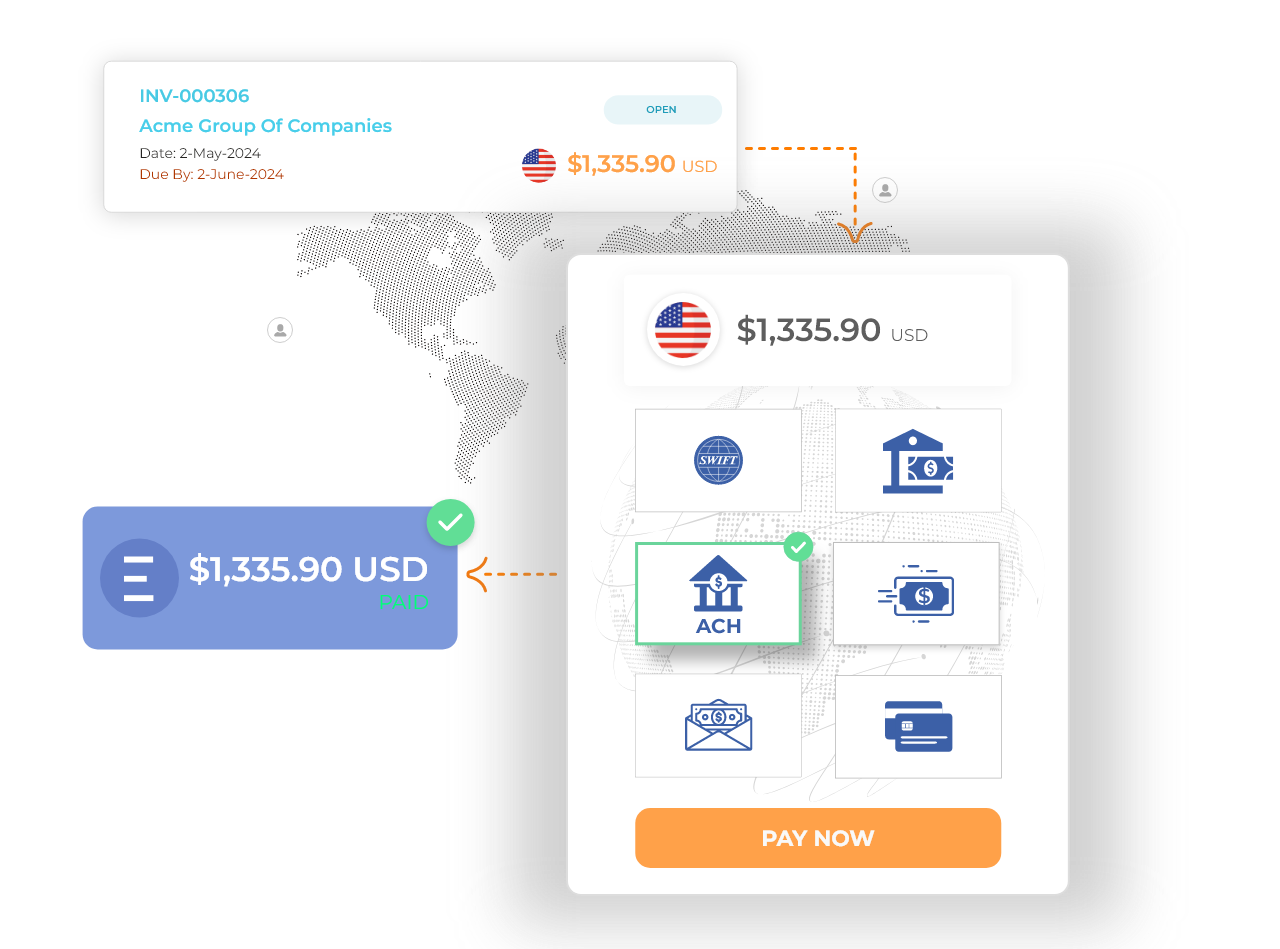

Expand your customer base by adding ACH as a payment option.

Securely accept ACH payments from your US-based clientele into your own FBO account. Finally, a solution tailored to you, empowering control over your finances.

ACH payments offer a seamless, cost-effective alternative to traditional card networks, opening new avenues for businesses to receive payment.

A secure and convenient payment method that allows you to stay competitive. Receive prompt payments from your American customers by offering them a preferred way to pay.

Enjoy low-cost transactions and streamlined payment processing, saving you time and money.

Process ACH transactions of any volume effortlessly. Streamline your ACH processing with recurring transactions and bulk payments.

Receive funds promptly and effortlessly from your US customers through direct bank payments.

Reconcile ACH payments at large volumes.

Seamlessly integrate ACH processing into your suite of payment offerings. Our white-label solution empowers you to preserve the trust your customers place in your brand.

Remove the barriers in your AR collections process and watch your receivables soar. Accept ACH payments from your customers, while avoiding expensive wire fees.

Multiple settlement window options put more control at your fingertips. Cadency offers same-day and standard ACH. You choose the solution that suits your business needs.

Our team is ready with the solutions you need to advance your business.